FAQs

Ask away! We’re always available.

The Q&A below includes the most frequently asked questions about Equinox Gold’s properties, business plan, and capital structure.

Submit a Question

If you can’t find what you’re looking for, please fill out the Submit a Question form, email us directly at ir@equinoxgold.com or call us at +1 604-260-0516. We look forward to hearing from you!

Questions and Answers

During the first half of the year, our primary focus is advancing Greenstone commissioning so we can pour gold in the first half of 2024, as promised. At our operating mines, we are focused on optimizing production and cost controls. Key objectives for 2024 included:

-

Operations and development:

- Achieve production and cost guidance

- Initiate portal development for the Aurizona underground expansion

- Pour first gold at Greenstone in H1 2024 and ramp up to commercial production

- Advance permitting and engineering for the Castle Mountain Phase 2 expansion

- Advance dialogue with local communities at Los Filos to agree on long-term development plan

- Optimize Santa Luz recoveries and throughput

- Continue with year-on-year improvements to safety and environmental performance

-

Exploration:

- Replace reserves and expand resources

- Test regional targets at Aurizona and in Fazenda-Santa Luz district

-

Corporate:

- Maintain solid balance sheet and good cost controls

- Continue to expand the reporting metrics in our ESG Report

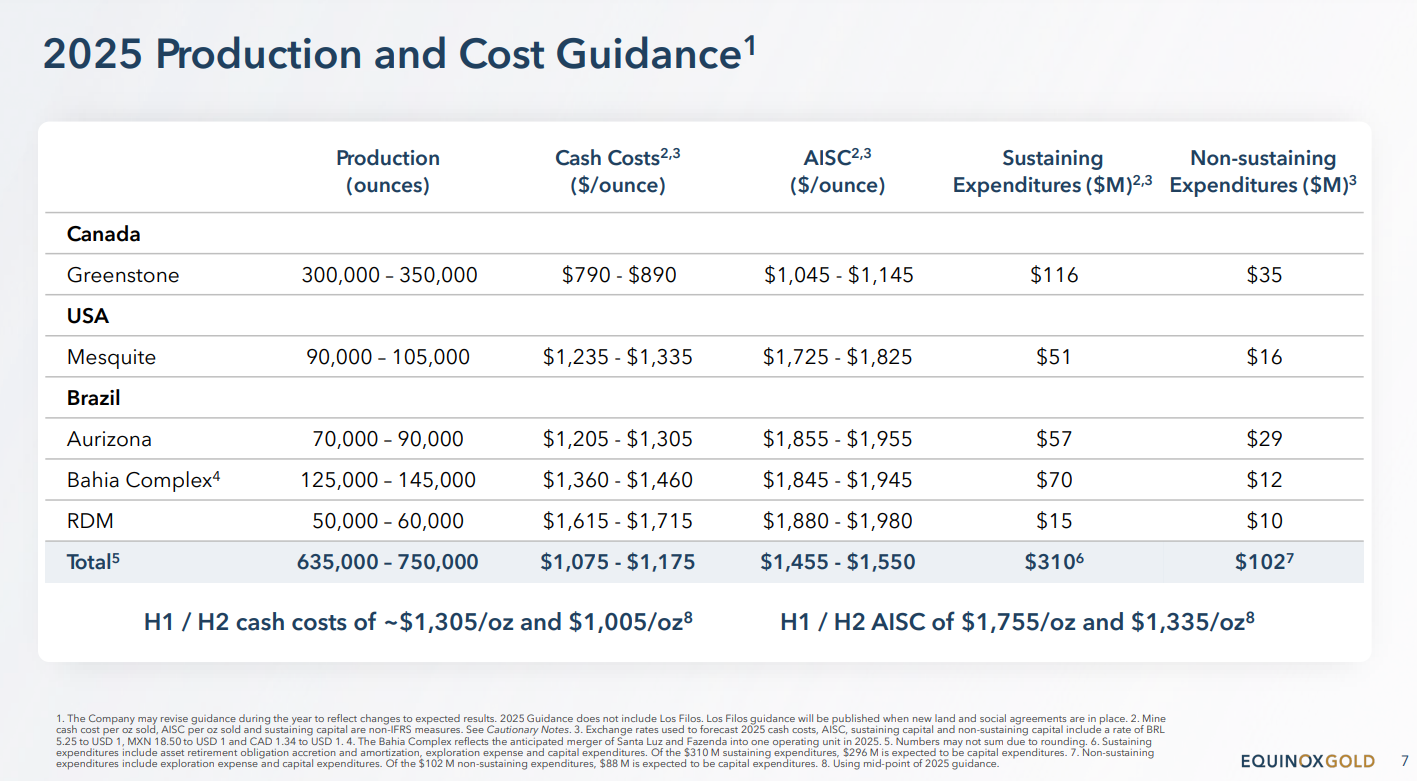

Equinox Gold released its 2025 production and cost guidance on February 19, 2025.

Equinox Gold investors can determine how many shares and warrants they hold by contacting Equinox Gold’s transfer agent, Computershare, as outlined below.

North American callers: 1-800-564-6253

International callers: 1-514-982-7555

By email: service@computershare.com

By mail: Computershare Investor Services 9th Floor, North Tower, 100 University Avenue Toronto, ON, Canada M5J 2Y1

Equinox Gold and its predecessor companies have completed a number of corporate actions since 2016 that may have affected the number of shares you hold and the number of shares issued to you upon exercise of warrants. The majority of these corporate actions are listed below. If you do not see information relating to the predecessor company in which you held shares, please contact Equinox Gold’s transfer agent, Computershare, for more information about your holdings in Equinox Gold.

Computershare Investor Services

Toll Free: +1-800-564-6253

International: +1 514-982-7555

Email: service@computershare.com

April 2021: Equinox Gold acquires Premier Gold. Premier Gold shareholders receive 0.1967 shares for every share held.

March 2020: Equinox Gold / Leagold merger. Leagold shareholders receive 0.331 EQX shares for every share held.

August 2019: Equinox Gold 5:1 share consolidation. EQX shares reduced by a factor of 5 (1,000 shares become 200 shares).

August 2018: Equinox Gold spins out copper assets to Solaris Resources (TSX-V: SLS). EQX shareholders get 0.10 shares in SLS for every EQX share held. In May 2020 Solaris completed a 2:1 share consolidation and SLS shares were reduced by a factor of 2 (1,000 shares became 500 shares).

May 2018: Leagold acquires Brio Gold. Brio Gold shareholders receive 0.922 LMC shares for every share held.

December 2017: Equinox Gold formed through merger of Trek Mining / Newcastle Gold / Anfield Gold. Trek Mining shares converted on 1:1 ratio. Newcastle shareholders receive 0.873 EQX shares for every share held. Anfield shareholders receive 0.407 EQX shares for every share held.

March 2017: Trek Mining formed through merger of JDL Gold / Luna Gold. JDL Gold shares converted on a 1:1 ratio. Luna Gold shareholders receive 1.105 Trek shares for every share held.

October 2016: JDL Gold 6.45:1 share consolidation. JDL shares reduced by a factor of 6.45 (1,000 shares become 155 shares).

October 2016: JDL Gold formed through merger of Lowell Copper / Gold Mountain / Anthem United. Lowell Copper shares converted on a 1:1 ratio. Gold Mountain shareholders receive 1.032 JDL shares for every share held. Anthem shareholders receive 0.774 JDL shares for every share held.

October 2016: Luna Gold 10:1 share consolidation. LMC shares reduced by a factor of 10 (1,000 shares become 100 shares).

If your shares were deposited in a trading account the conversions would have happened automatically.

If you still hold physical share certificates or DRS Advice you need to exchange your share and warrant certificates or DRS Advice with Computershare in order to receive your new Equinox Gold share certificates (and your Solaris Resources share certificates if you held Equinox Gold shares at August 2, 2018). Shareholders who fail to submit a duly completed Letter of Transmittal and all other documents required by Computershare within six years of the respective transaction will no longer have the right to receive shares and will not receive any compensation in lieu thereof.

If you have lost your share certificate or Letter of Transmittal, please contact Computershare at:

Computershare Investor Services

Toll Free: +1-800-564-6253

International: +1 514-982-7555

Email: service@computershare.com

Do not send your share certificates to Equinox Gold for exchange. They must be submitted to Computershare at:

Computershare Investor Services

9th Floor, North Tower, 100 University Ave

Toronto, ON, Canada M5J 2Y1

Email: corporateactions@computershare.com

1-800-564-6253

Equinox Gold has sold common shares and warrants in private placements to certain qualified U.S. investors. These shares and the shares issued upon exercise of warrants typically bear a U.S. securities legend that states that the shares were sold pursuant to an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended (the “1933 Act”), and that therefore the shares cannot be sold in the United States absent an exemption from registration under the 1933 Act.

Legended shares must have the legend/restriction removed before they can be deposited or sold.

If you have held your shares for more than one year, you can likely get the legend removed without involving your broker or US legal counsel. Please contact EQX Investor Relations at ir@equinoxgold.com for more information.

If you have held your shares for less than one year, you will need assistance from your broker or US legal counsel to get the legend removed. We advise shareholders seeking to remove such restrictive legends to contact their securities broker to obtain further instructions and the paperwork necessary to complete such removal, including the form of declaration to be provided to your securities broker. If you obtained your shares through a private placement, in your subscription agreement paperwork there is an “Appendix 1 to Schedule C” form that is the Form of Declaration for Removal of U.S. Legend. This form needs to be filled out, medallion guaranteed and couriered to Computershare Investor Services as per the instructions below.

If your broker is unable to assist with this process, please contact EQX Investor Relations at ir@equinoxgold.com for more information.

Exemption to allow the sale of Equinox Gold shares

One exemption potentially available to our U.S. resident shareholders, is Rule 904 of Regulation S under the 1933 Act (“Rule 904”), which serves as a resale safe harbor allowing persons (other than the Company, a distributor, any of their respective affiliates, or any person acting on their behalf) to offer and resell shares, provided, however, that the offer to sell the shares is not made to a person in the U.S. and either:

- At the time the buy order is originated, the buyer is outside the U.S., or the seller and any person acting on its behalf reasonably believe that the buyer is outside the U.S.; or

- the transaction is executed in, on or through the facilities of a designated offshore securities market (i.e. the TSX Venture Exchange), and neither the seller nor any person acting on its behalf knows that the transaction has been pre-arranged with a buyer in the U.S.

In addition to meeting other requirements under Rule 904, no “directed selling efforts” in or into the U.S. may be used to resell the shares.

Contacting Computershare

A shareholder wishing to resell shares in accordance with Rule 904 must request that the U.S. restrictive legend be removed from the certificates representing such shares, prior to such shares being sold. Only Computershare Investor Services Inc. (“Computershare”), the Company’s registrar and transfer agent, may remove restrictive legends from certificates representing shares of the Company. Computershare can be contacted at the following numbers:

Shareholder Services (if the securityholder is calling Computershare)

1-800-564-6253

Broker Services (if the broker is calling Computershare)

1-888-838-1405

Courier your declaration form to:

Computershare Investor Services Attn: Stock Transfer Department – For certificate issuance from DRS

Attn: Securities Transfer – For Legend Removal Requests

9th Floor, North Tower, 100 University Avenue

Toronto, ON, Canada M5J 2Y1

The paperwork to remove the restrictive legends requires a medallion signature guarantee. This is a guarantee by the transferring financial institution that the signature is genuine and the financial institution accepts liability for any forgery. Signature guarantees protect shareholders by preventing unauthorized transfers. They also limit the liability of the transfer agent who accepts the certificates. Different institutions have different policies as to what type of identification they require to provide the guarantee and whether they charge a fee for such service (usually nominal if any). Most institutions will not guarantee a signature of someone who has not already been their customer. Some institutions do not provide this service in which case you may need to open an account with a different institution. Financial institutions outside of the United States that have a correspondence relationship with a U.S. bank may be able to offer a medallion signature guarantee to existing customers.

Disclaimer

The rules and procedures concerning offshore securities transactions including, but not limited to, sales under Regulation S under the 1933 Act are technical, complex and subject to various restrictions and conditions. The foregoing does not constitute legal advice and if you have any questions or concerns regarding your ability to rely upon Regulation S to sell your shares of the Company, we strongly recommend that you seek independent legal advice before selling any such shares. Furthermore, Regulation S requires that we are a “foreign issuer” within the meaning of applicable securities laws at the time of sale of your shares of the Company. However, we are under no obligation to remain a “foreign issuer” and there are no assurances that we will be a “foreign issuer” at the time you propose to sell your shares of the Company. If we are not a “foreign issuer” at the time of sale, the exemption provided by Regulation S will not be available and the restrictive legend will remain on your share certificate(s).

Equinox Gold’s common shares trade in Canada on the TSX under the symbol “EQX” and in the United States on the NYSE American under the symbol “EQX”.

About Us

Creating the Premier Americas Gold Producer

Equinox Gold’s vision is to build an Americas-focused gold company with a reputation for excellence that safely and responsibly produces more than one million ounces of gold per year.

Learn More