Released on

Equinox Gold Increases Mesquite Reserves by 28% and Measured & Indicated Resources by 94%

Download PDFEquinox Gold Corp. (TSX: EQX, NYSE American: EQX) (“Equinox Gold” or the “Company”) is pleased to announce that exploration success during the first half of 2020 has significantly increased Mineral Reserves and Mineral Resources at the Company’s Mesquite Gold Mine (“Mesquite”) in California, USA.

Highlights

- Proven and Probable Mineral Reserves increased 28% to 658,000 ounces (“oz”) of contained gold net of mining depletion to June 30, 2020

- Measured and Indicated (“M&I”) Mineral Resources increased 94% to 837,000 oz of contained gold, exclusive of reserves

- Inferred Mineral Resources increased 38% to 703,000 oz of contained gold

- Ongoing exploration continues to demonstrate growth potential at the Brownie deposit; initial drilling highlights include: 35.1 metres (“m”) at 0.51 grams per tonne (“g/t”) gold; 33.5 m at 0.66 g/t gold; 52.6 m at 0.85 g/t gold; and 44.2 m at 0.58 g/t gold

Scott Heffernan, EVP Exploration of Equinox Gold, stated: “Exploration efforts at Mesquite in the first half of 2020 more than replaced mined reserves and significantly increased mineral resources, providing additional mine life at what has been our best-performing mine this year. Drilling in the Brownie deposit also yielded excellent results and points to potential for a multi-year mine life extension from in-situ mineralization and overlying mineralized dumps.”

Mesquite Mineral Reserve Update

Building on the significant improvements achieved in the recent December 31, 2019 Mineral Reserve and Mineral Resource estimates, this mid-year 2020 update includes an additional 10,785 m (77 holes) of bedrock drilling, 36,785 m (661 holes) of drilling targeting historical dumps, and updated geologic and grade-shell domains.

Mesquite Proven and Probable Mineral Reserves at June 30, 2020 are estimated at 37.8 million tonnes (“Mt”) grading 0.54 g/t gold for 658,000 oz of contained gold (Table 1, with Imperial units provided in the Appendix to this news release). Net of mining depletion (68,267 oz of Proven and Probable Reserve) during the first half of 2020, the updated Mineral Reserve represents a 28% increase (142,267 oz). The updated Mineral Reserve estimate uses the same design and parameters as the December 31, 2019 estimate. A redesign will commence upon completion of exploration and geotechnical drill programs.

Mesquite Mineral Resource Update

Mesquite Measured and Indicated Mineral Resources at June 30, 2020, exclusive of Mineral Reserves, are estimated at 66.7 Mt grading 0.39 g/t gold for 837,000 oz of contained gold (Table 2, with Imperial units provided in the Appendix to this news release). This represents a 94% increase when compared to the previous Measured and Indicated Mineral Resource estimate of 432,000 oz of gold. Inferred Mineral Resources at June 30, 2020 are estimated at 69.2 Mt grading 0.32 g/t gold for 703,000 oz of contained gold (Table 2), representing a 38% increase compared to the previous estimate of 510,000 oz of gold.

At year-end 2019, the Company had identified approximately 40 million short tons of potentially mineralized material from previous operations that had not been drill tested and the Company initiated a 35,000 m exploration drill program. Drilling in the Big Chief, Midway and Brownie dumps yielded significant gains in Mineral Resources. Indicated Mineral Resources in the dumps have increased more than fourfold to 22.7 Mt grading 0.22 g/t gold for 160,000 oz of contained gold. Inferred Mineral Resources in the dumps have increased 31% to 36.6 Mt grading 0.22 g/t gold for 255,000 contained oz of gold. The increases as noted do not reflect depletion of resource material contained in the 2019 year-end Mineral Resource that has already been stacked on the leach pad.

Table 1: Mesquite Mineral Reserve Estimate at June 30, 2020

| Ore Type | Proven Reserves | Probable Reserves | Proven & Probable Reserves | ||||||

| Tonnes (kt) |

Gold Grade (g/t) | Contained Gold (koz) |

Tonnes (kt) |

Gold Grade (g/t) | Contained Gold (koz) |

Tonnes (kt) |

Gold Grade (g/t) | Contained Gold (koz) | |

| Oxide | – | – | – | 18,559 | 0.40 | 239 | 18,559 | 0.40 | 239 |

| Transition | 10 | 0.98 | – | 2,968 | 0.62 | 59 | 2,978 | 0.62 | 59 |

| Non-oxide | 105 | 1.04 | 4 | 16,173 | 0.69 | 356 | 16,278 | 0.69 | 360 |

| Total | 115 | 1.05 | 4 | 37,700 | 0.54 | 654 | 37,815 | 0.54 | 658 |

Notes: This Mineral Reserve estimate has an effective date of June 30, 2020 and is based on the Mineral Resource estimate prepared by Ali Shakar (Lions Gate Geological Consulting Inc.) The Mineral Reserve calculation was completed under the supervision of Gordon Zurowski, P.Eng. (AGP Mining Consultants Inc.), who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final design pit based on a $1,350/oz gold price. The cut-off grade varied by material type from 0.14 g/t for oxide and oxide-transition and 0.31 g/t for non-oxide materials. The mining cost averaged $1.60/t mined, processing costs are $2.26/t ore and G&A was $0.77/t ore placed. The gold recoveries were 75% for oxide and 35% for non-oxide material. Oxide ore includes dump material identified as reserves.

Table 2: Mesquite Mineral Resource Estimate (Exclusive of Reserves) at June 30, 2020

| Ore Type | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

| Tonnes (kt) | Grade (g/t) | Gold (koz) | Tonnes (kt) | Grade (g/t) | Gold (koz) | Tonnes (kt) | Grade (g/t) | Gold (koz) | Tonnes (kt) | Grade (g/t) | Gold (koz) | |

| Oxide | 5 | 0.65 | 0 | 10,434 | 0.40 | 133 | 10,439 | 0.40 | 133 | 11,138 | 0.41 | 145 |

| Non-oxide | 40 | 0.40 | 1 | 33,572 | 0.50 | 543 | 33,612 | 0.50 | 544 | 21,395 | 0.44 | 303 |

| Dumps | – | – | – | 22,695 | 0.22 | 160 | 22,695 | 0.22 | 160 | 36,654 | 0.22 | 255 |

| Total | 45 | 0.42 | 1 | 66,701 | 0.39 | 836 | 66,746 | 0.39 | 837 | 69,187 | 0.32 | 703 |

Notes: Mineral Resources have an effective date of June 30, 2020 and are reported exclusive of Mineral Reserves. Mineral Resources were restricted between the December 31, 2019 Reserve pit designs and the ultimate resource limiting pit shell based on a gold price of $1,500/oz, a mining cost of $1.60/t mined, a processing cost of $2.26/t ore and G&A of $0.77/t ore. Oxide and oxide transition have an assumed recovery of 75% and cut-off grade of 0.09 g/t. Non-oxide and non-oxide transition have an assumed recovery of 35% and cut-off grade of 0.18 g/t. Waste dump material has an assumed recovery of 75% and cut-off grade of 0.14 g/t. Ali Shahkar P.Eng. of Lions Gate Geological Consulting Inc. is the Qualified Person under NI 43-101 responsible for the in-situ mineral resource estimation. Robert Sim, P.Geo. of SIM Geological Inc. is the Qualified Person under NI 43-101 responsible for the waste dump mineral resource estimation. Numbers may appear not to sum properly due to rounding. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. See Cautionary Notes and Technical Disclosure Statement at the end of this news release.

Brownie Expansion Drilling Program

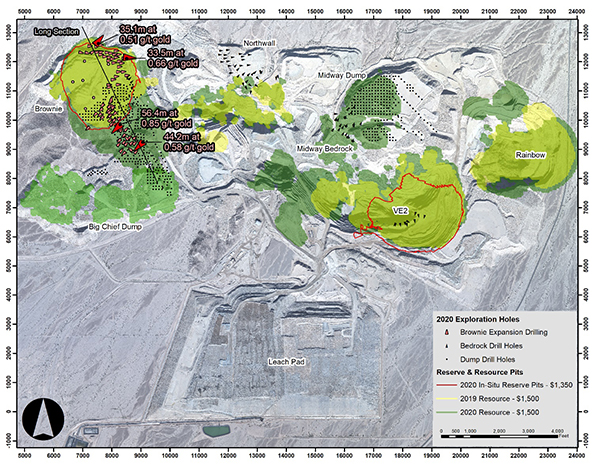

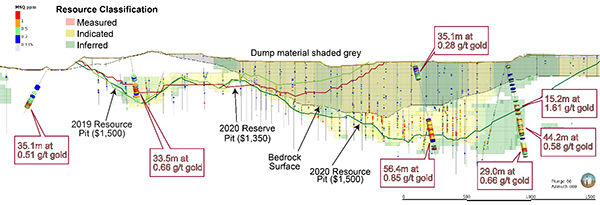

Drilling in 2019 provided confirmation that the dump material overlying the Brownie deposit area contains significant gold resources and that in-situ mineralization was present adjacent to and extending from the resource pit. A follow-up 13,897 m drill program was carried out to test the potential to extend mineralization along strike and down dip (Figure 1). Drilling results include highlights of 35.1 m at 0.51 g/t gold, 33.5 m at 0.66 g/t gold, 52.6 m at 0.85 g/t gold, and 44.2 m at 0.58 g/t gold. The results increase confidence in the geological model and highlight the potential for further expansion potential to the north, northwest and southeast of the existing resources (Figure 2).

Figure 1: Mineral Resource and Mineral Reserve Map of the Mesquite Mine with 2020 Drilling

Figure 2: Long Section of Brownie Deposit, Overlying Dumps and Expanded Mineral Resource Facing Northeast

Qualified Persons

Ali Shahkar, P.Eng. of Lions Gate Geological Consulting Inc., is the Qualified Person under National Instrument 43-101 (“NI 43-101”) responsible for the in-situ Mineral Resource estimation. Robert Sim, P.Geo. of SIM Geological Inc., is the Qualified Person under NI 43-101 responsible for the waste dump Mineral Resource estimation. The Mineral Reserve calculation was completed under the supervision of Gordon Zurowski, P.Eng. of AGP Mining Consultants, who is a Qualified Person as defined under NI 43-101. These Qualified Persons are independent of the Company and have reviewed and approved of the contents of this news release. The Mineral Reserve and Mineral Resource estimates were prepared in accordance with standards as defined by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) in “CIM Definition Standards on Mineral Resources and Mineral Reserves” adopted by CIM Council on May 10, 2014.

The June 30, 2020 Mesquite Mineral Reserves and Mineral Resources update was based on technical information regarding the Mesquite property originally reported in the “Technical Report on the Mesquite Gold Mine, California, U.S.A.” (the “Mesquite Technical Report”) dated March 18, 2020 with an effective date of December 31, 2019, prepared by AGP Mining Consultants Inc. and also incorporates newly acquired data. The Qualified Persons as defined by National Instrument 43-101 who prepared or supervised the preparation of the information contained in the report are Bruce Davis, FAusIMM (BD Resource Consulting, Inc.), Nathan Robison, PE (Robison Engineering Company Inc.), Ali Shahkar P.Eng. (Lions Gate Geological Consulting Inc.), Robert Sim, P.Geo. (SIM Geological Inc.), Jefferey Woods, SME MMAS (Woods Process Services, LLC) and Gordon Zurowski, P.Eng (AGP).

Scott Heffernan, MSc, P.Geo., Equinox Gold’s EVP Exploration, is responsible for the drilling programs at Mesquite, is a Qualified Person under National Instrument 43-101 for Equinox Gold and has reviewed, approved and verified the technical content of this news release. Doug Reddy, MSc., P.Geo., Equinox Gold’s Chief Operating Officer, is a Qualified Person under National Instrument 43-101 for Equinox Gold and has also reviewed and verified the technical content of this news release.

About Equinox Gold

Equinox Gold is a Canadian mining company with seven operating gold mines and a clear path to achieve one million ounces of annual gold production from a pipeline of development and expansion projects. Equinox Gold operates entirely in the Americas, with two properties in the United States, one in Mexico and four in Brazil. Equinox Gold’s common shares are listed on the TSX and the NYSE American under the trading symbol EQX. Further information about Equinox Gold’s portfolio of assets and long-term growth strategy is available at www.equinoxgold.com or by email at ir@equinoxgold.com.

CAUTIONARY NOTES AND FORWARD-LOOKING STATEMENTS

Technical Disclosure

Mesquite Mineral Resources are reported exclusive of Mineral Reserves. Mineral Resources were restricted between the June 30, 2020 Reserve pit designs and the ultimate resource limiting pit shell based on a gold price of $1,500/oz, mining cost of $1.60/t mined and a processing cost of $2.26/t ore and G&A was $0.77/t ore placed. Gold recoveries had an assumed recovery of 75% for oxide and 35% for non-oxide materials. The cut-off grade varied by material type from 0.09 g/t for oxide and oxide-transition and 0.18 g/t for non-oxide transition and non-oxide materials. Waste dump material has an assumed recovery of 75% and cut-off grade of 0.14 g/t. Ali Shahkar P.Eng. of Lions Gate Geological Consulting Inc. is the Qualified Person under NI 43-101 responsible for the in-situ mineral resource estimation. Robert Sim, P.Geo. of SIM Geological Inc. is the Qualified Person under NI 43-101 responsible for the waste dump mineral resource estimation. Numbers may not total due to rounding. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The Mineral Reserve estimate has an effective date of June 30, 2020 and is based on the Mineral Resource estimate dated June 30, 2020 prepared by Lions Gate Geological Consulting Inc. The Mineral Reserve calculation was completed under the supervision of Gordon Zurowski, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final design pit based on a $1,350/oz gold price. The cut-off grade varied by material type from 0.14 g/t for oxide and 0.31 g/t for non-oxide materials. The mining cost averaged $1.60/t mined, processing costs are $2.26/t ore and G&A was $0.77/t ore placed. The ore recoveries were 75% for oxide and 35% for non-oxide materials. The June 30, 2020 Mesquite Mineral Reserves and Mineral Resources update was based on technical information regarding the Mesquite property originally reported in the “Technical Report on the Mesquite Gold Mine, California, U.S.A.” (the “Mesquite Technical Report”) dated March 18, 2020 with an effective date of December 31, 2019, prepared by AGP Mining Consultants Inc. The Qualified Persons as defined by National Instrument 43-101 who prepared or supervised the preparation of the information contained in the report are Bruce Davis, FAusIMM (BD Resource Consulting, Inc.), Nathan Robison, PE (Robison Engineering Company Inc.), Ali Shahkar P.Eng. (Lions Gate Geological Consulting Inc.), Robert Sim, P.Geo. (SIM Geological Inc.), Jefferey Woods, SME MMAS (Woods Process Services, LLC) and Gordon Zurowski, P.Eng (AGP). Numbers may not sum due to rounding.

Drill composites were calculated using cut-off values of 0.14 g/t and contain no more than 5 metres of internal waste. Drill intersections are calculated using uncut assays and reported as drilled thickness. All samples were submitted to American Assay Lab in Reno, NV for sample preparation and analysis. All samples were crushed and pulverized from which a 1 kg sample pulp was taken for the following analyses: a 50-gram fire assay for gold; a 48 multi-element geochemical suite by 5-acid digestion and Inductively-Coupled Mass Spectrometry (ICP-MS); and a total sulphur and sulphide sulphur analysis. Samples with fire assay gold values over 10.0 g/t gold are re-assayed bye Screen Metallics fire assay. Control samples (accredited standards, blanks, and duplicate samples at the field and preparation stages) were inserted on a regular basis and results were monitored upon receipt of assays.

Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Information regarding Mineral Reserve and Mineral Resource estimates has been prepared in accordance with Canadian standards under applicable Canadian securities laws and may not be comparable to similar information for United States companies. The terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” used in this news release are Canadian mining terms as defined in accordance with NI 43-101 under guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014. While the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by Canadian regulations, they are not defined terms under standards of the United States Securities and Exchange Commission. Under United States standards, mineralization may not be classified as a “Reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve calculation is made. As such, certain information contained in this news release concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the United States Securities and Exchange Commission. While an “Inferred Mineral Resource” has a great amount of uncertainty as to its existence and as to its economic and legal feasibility, it can be reasonably expected that the majority of an “Inferred Mineral Resource” could be upgraded to an “Indicated Mineral Resource” with continued exploration. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Resources will ever be converted into Mineral Reserves. Readers are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists or is economically or legally mineable. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under CIM standards differ in certain respects from the standards of the United States Securities and Exchange Commission.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information. Forward-looking statements and forward-looking information in this news release relate to, among other things, expectations regarding production and future financial or operational performance of the Mesquite Mine, including the growth potential of the Brownie deposit and conversion of Mineral Resources to Mineral Reserves. Forward-looking statements or information generally identified by the use of the words “will”, “confidence”, “potential”, “planned”, “objective”, “can”, “continue”, “estimate, “growth” and similar expressions and phrases or statements that certain actions, events or results “may”, “could”, “would” or “should”, or the negative connotation of such terms, are intended to identify forward-looking statements and information. Although the Company believes that the expectations reflected in such forward-looking statements and information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. The Company has based these forward-looking statements and information on the Company’s current expectations and projections about future events and these assumptions include: the results of planned and future drill programs at Mesquite, the Company’s ability to extend the mine life at Mesquite, the Company’s Mineral Reserve and Resource estimates and the assumptions on which they are based, including the Company’s ability to upgrade Inferred Resources to Indicated Resources, availability of funds for the Company’s projects and future cash requirements; prices for energy inputs, labour, materials, supplies and services; no labour-related disruptions and no unplanned delays or interruptions in scheduled exploration, development and production, including by blockade; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the Company’s ability to comply with environmental, health and safety laws. While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Accordingly, readers are cautioned not to put undue reliance on the forward-looking statements or information contained in this news release.

The Company cautions that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements and information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services; fluctuations in currency markets; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); inadequate insurance, or inability to obtain insurance to cover these risks and hazards; employee relations; relationships with, and claims by, local communities and indigenous populations; the Company’s ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner or at all; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mining including those imposed in connection with COVID-19; risks relating to expropriation; increased competition in the mining industry; and those factors identified in the Company’s MD&A dated February 28, 2020 for the year ended December 31, 2019 and its Annual Information Form dated May 13, 2020, which are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/EDGAR. Forward-looking statements and information are designed to help readers understand management’s views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, the Company assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement or information contained or incorporated by reference to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements and information. If the Company updates any one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements. All forward-looking statements and information contained in this news release are expressly qualified in their entirety by this cautionary statement.

APPENDIX

Mesquite Mineral Reserve Estimate at June 30, 2020

(Imperial Units)

| Ore Type | Proven Reserves | Probable Reserves | Proven & Probable Reserves | ||||||

| Tons (kt) | Gold Grade (oz/t) | Contained Gold (koz) | Tons (kt) | Gold Grade (oz/t) | Contained Gold (koz) | Tons (kt) | Gold Grade (oz/t) | Contained Gold (koz) | |

| Oxide | – | – | – | 20,462 | 0.012 | 239 | 20,462 | 0.012 | 239 |

| Transition | 11 | 0.029 | – | 3,272 | 0.018 | 59 | 3,283 | 0.018 | 59 |

| Non-oxide | 116 | 0.031 | 4 | 17,831 | 0.020 | 356 | 17,947 | 0.020 | 360 |

| Total | 127 | 0.031 | 4 | 41,565 | 0.016 | 654 | 41,692 | 0.016 | 658 |

Notes: This Mineral Reserve estimate has an effective date of June 30, 2020 and is based on the Mineral Resource estimate dated June 30, 2020 prepared by Lions Gate Geological Consulting Inc. The Mineral Reserve calculation was completed under the supervision of Gordon Zurowski, P.Eng. of AGP Mining Consultants Inc., who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final design pit based on a $1,350/oz gold price. The cut-off grade varied by material type from 0.004 oz/ton for oxide and oxide-transition and 0.009 oz/ton for non-oxide transition and non-oxide materials. The mining cost averaged $1.45/ton mined, processing costs are $2.05/ton ore and G&A was $0.70/ton ore placed. The ore recoveries were 75% for oxide and 35% for non-oxide material. Numbers may not total due to rounding. See Cautionary Notes and Technical Disclosure Statement.

Mesquite Mineral Resource Estimate (Exclusive of Reserves) at June 30, 2020

(Imperial Units)

| Ore Type | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

| Tons (kt) | Grade (oz/t) | Gold (koz) | Tons (kt) | Grade (oz/t) | Gold (koz) | Tons (kt) | Grade (oz/t) | Gold (koz) | Tons (kt) | Grade (oz/t) | Gold (koz) | |

| Oxide | 6 | 0.019 | 0 | 11,504 | 0.012 | 133 | 11,510 | 0.012 | 133 | 12,280 | 0.012 | 145 |

| Non-oxide | 44 | 0.012 | 1 | 37,014 | 0.015 | 543 | 37,058 | 0.015 | 544 | 23,589 | 0.013 | 303 |

| Dumps | – | – | – | 25,022 | 0.006 | 160 | 25,022 | 0.006 | 160 | 40,412 | 0.006 | 255 |

| Total | 50 | 0.012 | 1 | 73,540 | 0.011 | 836 | 73,590 | 0.011 | 837 | 76,281 | 0.009 | 703 |

Notes: Mineral Resources have an effective date of June 30, 2020 and are reported exclusive of Mineral Reserves. Mineral Resources were restricted between the June 30, 2020 Reserve pit designs and the ultimate resource limiting pit shell based on a gold price of $1,500/oz, mining cost of $1.45/ton mined and a processing cost of $2.05/ton ore. Oxide and oxide transition have an assumed recovery of 75% and cut-off grade of 0.0025 oz/ton. Non-oxide and non-oxide transition have an assumed recovery of 35% and cut-off grade of 0.0053 oz/t. Waste dump material has an assumed recovery of 75% and cut-off grade of 0.004 oz/ton. Ali Shahkar P.Eng. of Lions Gate Geological Consulting Inc. is the Qualified Person under NI 43-101 responsible for the in-situ mineral resource estimation. Robert Sim, P.Geo. of SIM Geological Inc. is the Qualified Person under NI 43-101 responsible for the waste dump mineral resource estimation. Numbers may not appear to sum properly due to rounding. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. See Cautionary Notes and Technical Disclosure Statement.